New Tax Brackets in 2018

The 2017 Tax Cuts and Jobs Act revised some foundational deductions, exemptions, and tax brackets for the 2018 tax year. Here’s a rundown of what’s changed in that area for individuals:

Exemption

On your 2017 1040 tax return, you likely received an exemption of $4,050 per person. Check line 42 of your own return. In 2018, this exemption is discontinued, but you won’t really lose out because the standard deduction has increased to compensate for this elimination.

Standard Deduction

In 2017, your standard deduction was $6,350 per person in general and $9,350 for head of household. In 2018, the standard deduction will increase to $12,000 per person and $18,000 for head of household filers.

Quite a few itemized deductions have been eliminated or capped for 2018, so more taxpayers will be using the standard deduction going forward.

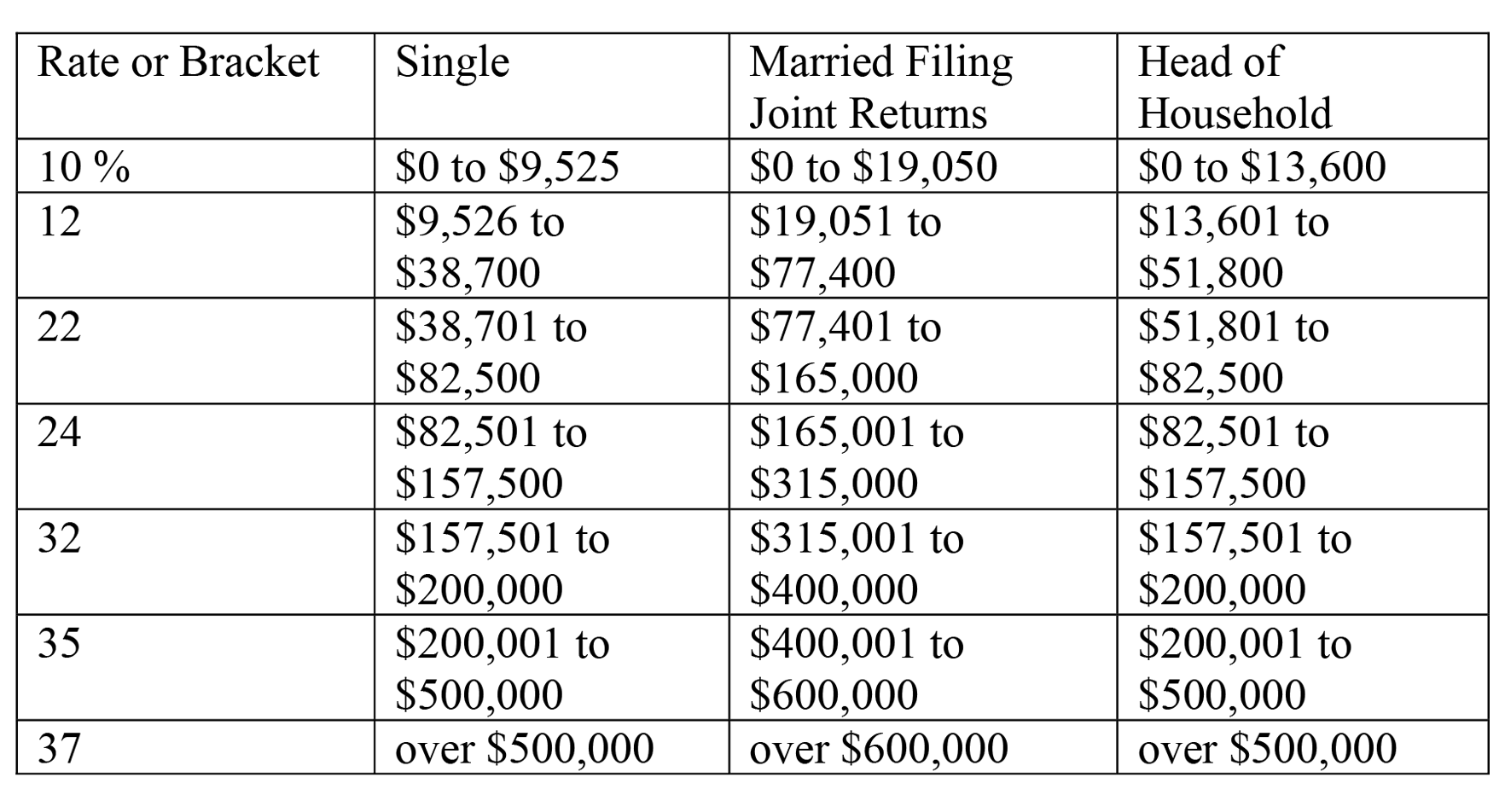

Tax Brackets

There are seven tax rates or brackets, just like there were before, but the threshholds and rates have changed. The rates now range from 10 percent to 37 percent:

- 10 percent

- 12 percent

- 22 percent

- 24 percent

- 32 percent

- 35 percent

- 37 percent

Here are the details depending on your filing status:

The new withholding tables are posted here:

https://www.irs.gov/pub/irs-pdf/n1036.pdf

If you have questions about this or anything about the new law, please feel free to reach out any time.